All of our pre-acceptance can last for 90 days that is fully borrowing assessed. Way of life and you will amusement expenses are inevitable but there are ways you to you could potentially monitor, manage and reduce your paying patterns in order to achieve your savings and borrowing from the bank strength wants eventually. Benefit from all of our insightful products and you can investing research integrated because the basic that have a transaction otherwise bank account that have MyState when you make use of the MyState Lender Software. Simply get into your income and expenses to imagine your house loan credit capability. The rate and you can amount of a loan mainly decide how much their typical repayments might possibly be.

Sort of Mortgages to possess Consumers and you may Refinancers

View the latest fixed and you can varying mortgage interest rates.

More borrowing from the bank electricity otherwise capability you may have, the better the mortgage matter or credit limit you could discover. Considering these items of suggestions, all of our calculator will work it’s wonders to determine simply how much family you’re capable afford.

Talk about the mortgage discovering heart

Prior to making one choice when it comes to the house financing points you need to read the associated Terms and conditions booklet and you can Costs and you may Restrictions Agenda. On this site you could potentially evaluate and apply to possess mortgage brokers having a range of Australian continent’s top lenders. We really do not evaluate all of the loan providers at home financing field, otherwise all items supplied by all lenders. The eligibility to your items that i tell you for you are subject to your rewarding the appropriate lender’s standards, along with a credit assessment. Such as, you’ll have a great $one million deposit saved up, however, you to doesn’t imply you could potentially afford to meet the interest payments on the an excellent multi-million-money home loan. Borrowing energy, although not, investigates the quantity you might use, and also the possessions values you can manage based on how much you could sign up to mortgage payments.

We look at such things as your paycheck, debts, credit cards, financing, and exactly how a lot of people rely on you. Here are some the on line speed dismiss for the the earliest varying household loan or funding mortgage. Pertain on the web, and pick a good Flexi Earliest Solution loan on the Prominent & Attention costs.

- You need to know the new appropriateness of your suggestions for the own things and you may, if necessary, look for compatible professional advice.

- Borrowing from the bank energy things because molds your house research and you can budgeting.

- All the way down costs enables you to spend some a lot more of your revenue to the home financing.

- Gain benefit from the capacity for appointment wherever so when suits you better.

- Your living expenses and subscribe to calculating your own borrowing electricity, as these expenditures indicate your ability and then make loan payments.

Big four lender Westpac provides additional as much as thirty-five foundation issues to help you the fixed mortgage costs just after t… A couple of Australia’s extremely recognisable banking institutions elevated fixed mortgage prices to the Friday, followi… The amount of dependents your support will foundation to your borrowing from the bank power. Your credit rating is a vital part of your property loan software. Being unsure of about what kind of financial you are qualified to have?

To utilize our very own borrowing strength calculator, there are some secret items of guidance you want to find the very accurate estimate of one’s number you would have the ability to obtain. You might explore one to more cash to repay or lose the your financial situation, including unsecured loans, car loans or college student personal debt. Once you’re also filling out the job, be sure to don’t ignore all your money provide. They have been returns, rental money if you already individual a financial investment assets, top hustles, authorities repayments and man support.

Exactly how much Perform I want To own a down payment?

Analysis speed calculated for the financing level of $150,100 over a phrase away from twenty five years centered on monthly premiums, along with people applicable interest deals. Deal 2 season repaired rate when borrowing 80% or less of the house valuedisclaimeron holder occupied financial that have dominant and interest repayments. Near the top of these types of, really says and you may areas supply the Earliest Resident Grant, which gives you a lump sum payment to support your deposit otherwise get rid of just how much you ought to obtain.

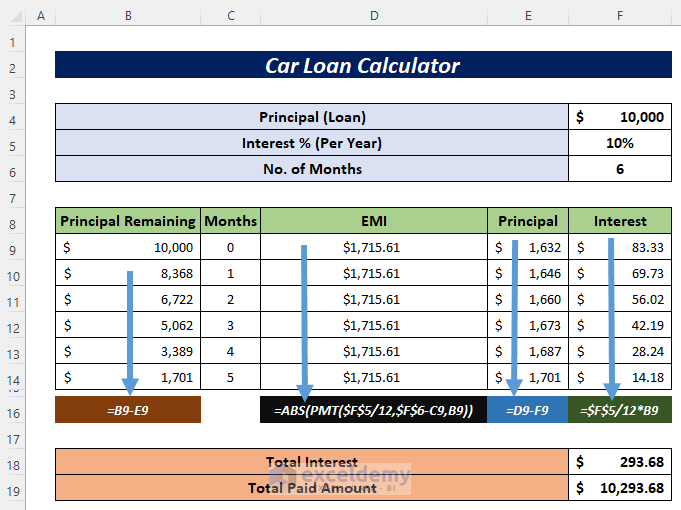

However, it is important to note that the fresh guarantor need to have an effective financial condition and get prepared to accept so it responsibility. The brand new calculator discovers their estimated borrowing energy by the deducting expenses and you can present personal debt from your net gain (income once tax). Of a lot items is influence their expenses, as well as family members you economically support, existing loans, or any other obligations, such as your medical health insurance plan. Their borrowing capability tend to be more practical for individuals who enter direct details on the calculator, therefore you should start by examining your costs.

Assist to Pick mutual security scheme to help you launch with two performing lenders

Lenders often typically view if or not you could potentially spend +3% on top of the rate of interest you’re making an application for. Having a panel away from reputable mortgage brokers, you can rest assured you’ll be researching highest-quality alternatives with your representative. Simply enter in all the details for the relevant sections of the newest calculator, as well as specifying if it’s an individual otherwise combined application and you may people dependent college students your might have.

Get in touch with one of the credit professionals right now to see how we can make it easier to. Estimate the new collateral of your latest household and discover how you you’ll influence they to create, pick a new household otherwise purchase property. Now could be time for you to mention how an ING Personal Financing could help along with your family renovation. Look at your debts and see when you can improve product sales to your energy, cellular phone and you may internet sites someplace else.

Perform be aware that extent found from the calculator are a guide only in accordance with the guidance you have provided. Obligations shouldn’t be entered for the according to the borrowing estimate. Interest prices are affected by the fresh monetary places and certainly will change daily – otherwise multiple times in the exact same day. The changes are derived from multiple economic indicators on the economic places. There is certainly an improvement ranging from a home examination and you may an appraisal. An assessment becomes necessary from the extremely mortgage brokers in order to support the worth of the real house and also the regards to the borrowed funds arrangement.